montana sales tax rate change

10 Montana Highway Patrol. The 2022 state personal income tax brackets.

Montana Income Tax Information What You Need To Know On Mt Taxes

The Montana Department of Revenue administers the states licensing distribution and taxation on Alcoholic Beverages.

. The minimum combined 2022 sales tax rate for Billings Montana is. 2022 Montana Sales Tax Table. Montana State might not impose a state sales tax but unfortunately thats not the case regarding registration fees.

The December 2020 total local sales tax rate was also 0000. Montana charges no sales tax on purchases made in the state. The County sales tax.

Montana does not have a. Remember that zip code boundaries dont always match up with political boundaries like Opheim or Valley. This is the total of state county and city sales tax rates.

Montana has a graduated individual income tax with rates ranging from 100 percent to 675 percent. The current total local sales tax rate in Big Sky MT is 0000. The County sales tax.

We can also see the progressive nature of Montana state income tax rates from the lowest MT tax rate bracket of 1 to the highest MT tax rate bracket of 675. Montana has a 675 percent corporate income tax rate. Combined Sales Tax Range.

The Laurel Montana sales tax rate of NA applies in the zip code 59044. There are no local taxes beyond the state rate. The state sales tax rate in Montana is 0000.

There are also additional fees that are added on top of the registration fee. The Montana sales tax rate is currently. The sales tax is paid by the purchaser and collected by the seller.

The Montana sales tax rate is currently. Base State Sales Tax Rate. Montana adopted structural reforms to both individual and corporate income taxes during the recently adjourned legislative session.

In Montana the registration charge for a 23407 car is 153. Local Sales Tax Range. The state sales tax rate in Montana MT is currently 0.

The minimum combined 2022 sales tax rate for Roy Montana is. June 1 2021. The registration fee in Montana is 8750.

The minimum combined 2022 sales tax rate for Bigfork Montana is. The Opheim Montana sales tax rate of NA applies in the zip code 59250. Montana Sales Tax Ranges.

The Montana sales tax rate is currently. An alternative sales tax rate of NA applies in the tax region Carbon which appertains to zip code 59044. Before the official 2022 Montana income tax rates are released provisional 2022 tax rates are based on Montanas 2021 income tax brackets.

The amendment would have prohibited the. The County sales tax rate is. North Dakota sales tax is comprised of 2 parts.

State Sales Tax The North Dakota sales tax rate is 5 for most retail. This is the total of state county and city sales tax rates. 368 rows There are a total of 68 local tax jurisdictions across the state collecting an average.

Registration in Montana. The Montana No State Sales Tax Amendment is not on the ballot in Montana as an initiated constitutional amendment on November 8 2022. You can learn more about licensing and.

This is the total of state county and city sales tax rates. A sales tax table is a printable sheet that you can use as a reference to easily calculate the sales tax due on an item of any price - simply round to the.

How To Pay Sales Tax For Small Business 6 Step Guide Chart

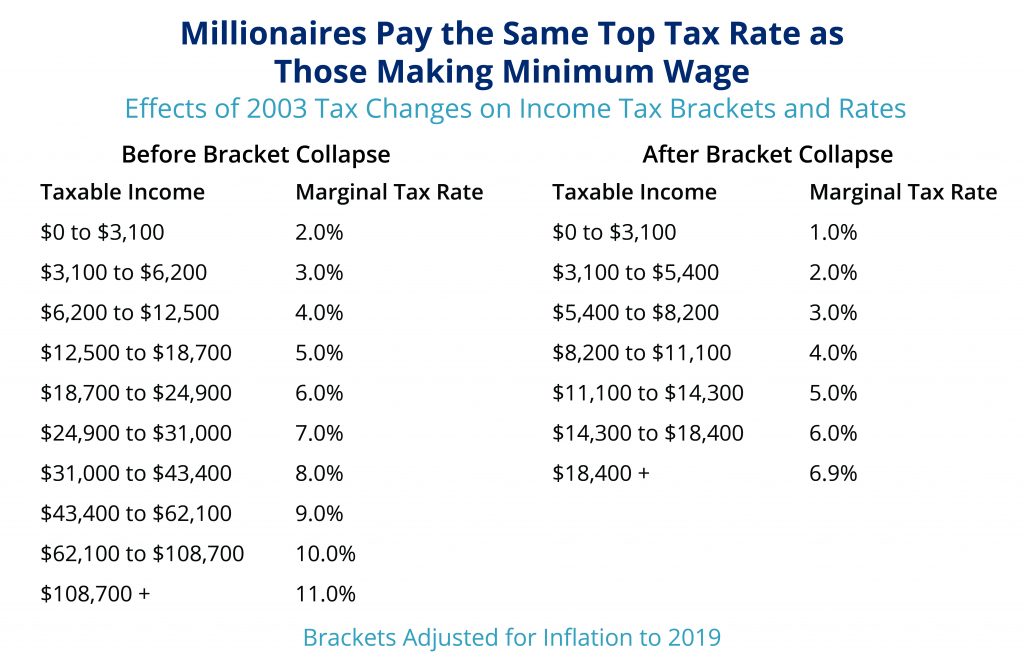

Policy Basics Individual Income Taxes In Montana Montana Budget Policy Center

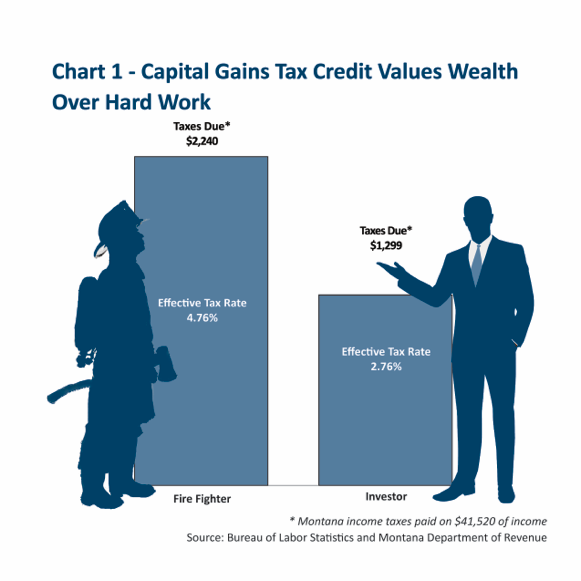

Capital Gains Tax Credit Valuing Wealth Over Work In Montana Montana Budget Policy Center

Taxes Fees Montana Department Of Revenue

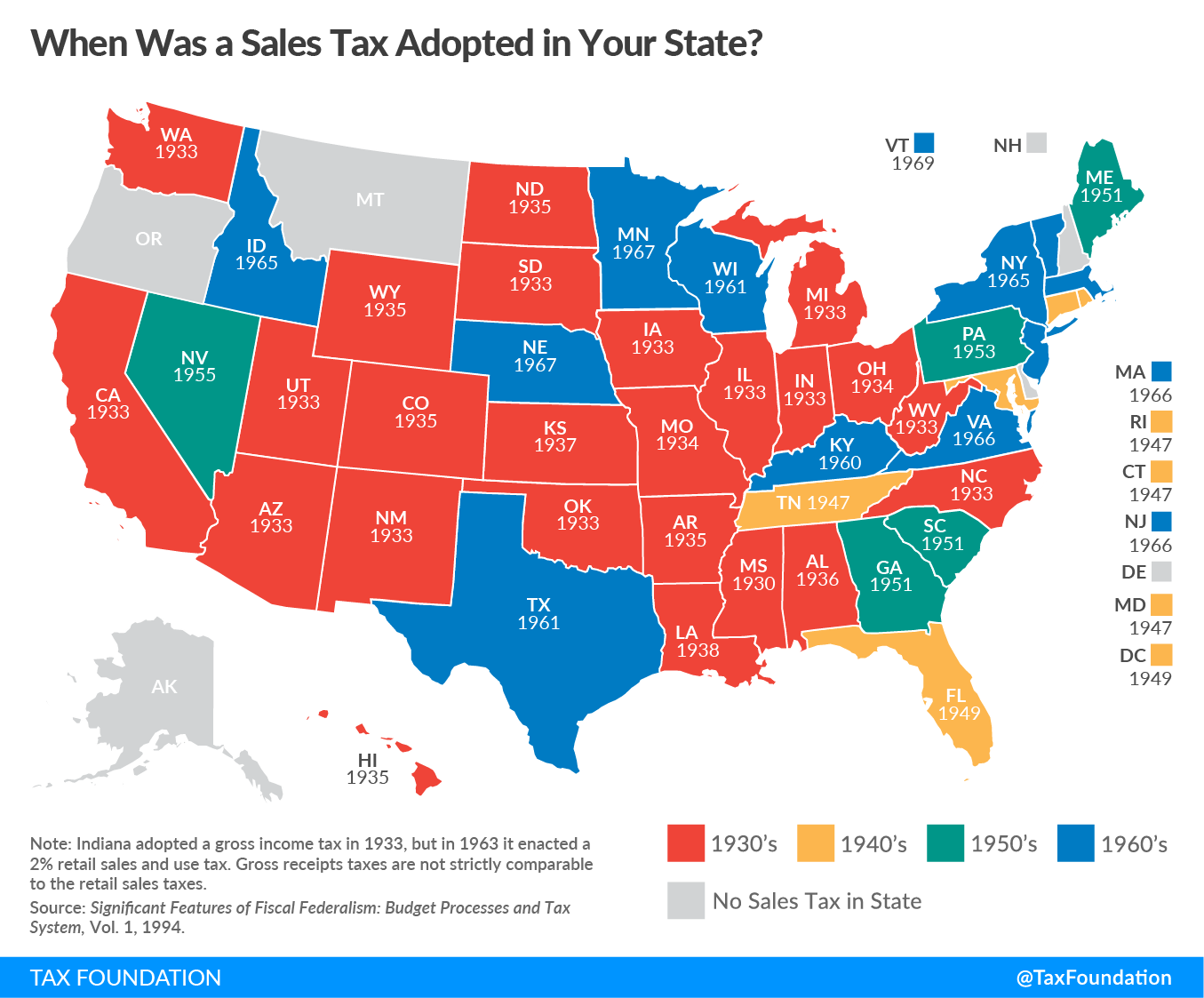

Sales Taxes In The United States Wikipedia

States Without Sales Tax Article

Montana State Taxes Tax Types In Montana Income Property Corporate

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Montana State Taxes Tax Types In Montana Income Property Corporate

Sales Tax Definition How It Works How To Calculate It Bankrate

Montana Retirement Tax Friendliness Smartasset

Montana State Tax Guide Kiplinger

State And Local Sales Tax Rates Midyear 2022

Should We Suspend Gas Taxes To Counter High Oil Prices Econofact

North Carolina Tax Reform Options A Guide To Fair Simple Pro Growth Reform Tax Foundation

How To Start A Business In Montana In 8 Simple Steps Starting Up 2022

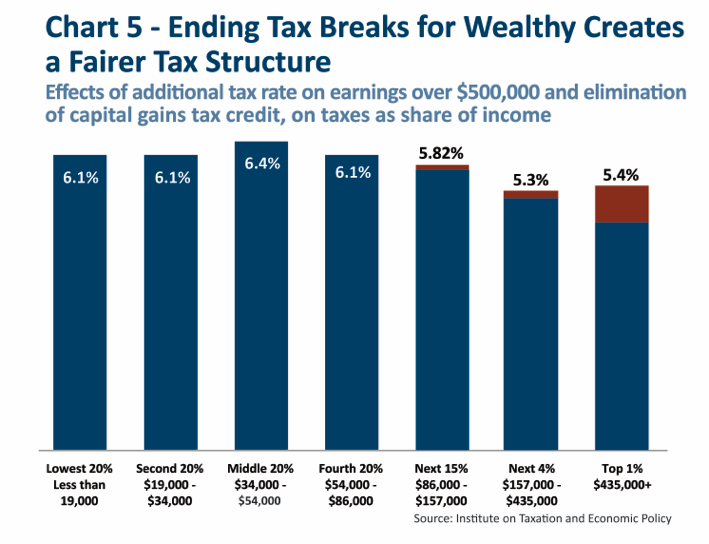

The Montana We Could Be Tax Cuts Aimed At The Rich Take A Toll Montana Budget Policy Center