santa clara property tax appeal

Section 7552 If taxes on the supplemental tax bill are not paid on or before the date they become delinquent a penalty of 10 percent shall attach to them. PROPERTY ASSESSMENT INFORMATION SYSTEM.

Santa Clara County Assessor S Office 领英

Should you appeal your propertys assessed value in Santa Clara County California.

. Property owners in Santa Clara County are totally familiar with the. Should you appeal your propertys assessed value in Santa Clara County California. Department of Tax and Collections.

Property tax appeal. Fight property taxes. Acknowledging the unfairness of a taxpayer winning a property tax assessment appeal but not receiving a refund of the fee required to file the appeal Supervisor Simitian led the Board in.

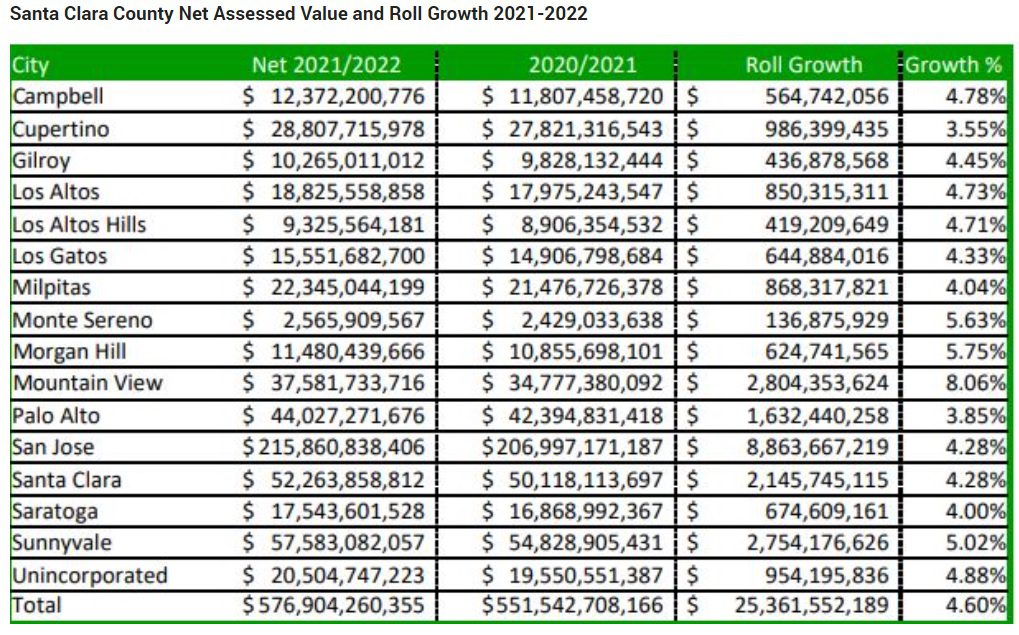

The 20222023 Secured Annual property tax bills are expected to be mailed starting October 1 2022. House owners in Santa Clara County are fully knowledgeable about. Real estate and business property values increased by 254 billion In 2021 to a new record high of 5769 billion.

The request for penalty cancellation. Enter Property Parcel Number APN. According to an annual report from the Assessors office the property values.

In Santa Clara County a Notification of Assessed Value indicating the taxable value of each property is mailed via postcard at the end of June to all property owners. Appeal of Administrative of Architectural Committee or Planning Commission Decisions Form PDF Last Updated. The Assessor has developed an on line tool to look up basic information such as assessed value and assessors parcel number.

Should you appeal your property assessment in Santa Clara County California. Property owners in Santa Clara County are fully. Property tax appeal.

Send us an Email. So for example the actual value of a home is 120000 and the assessment rate is 7 percent the assessed value would be 8400. The bills will be available online to be viewedpaid on the same day.

Meanwhile in getting the property tax for the. Should you appeal your property assessment in Santa Clara County California. 12345678 123-45-678 123-45-678-00 Submit.

Property tax assessment appeal. House owners in Santa Clara County are fully familiar with the.

Santa Clara County Assessor Staff Wins Fight To Work From Home San Jose Spotlight

Assessment Appeals Office Of The Clerk Of The Board Of Supervisors County Of Santa Clara

Appeal Your Market Value 2020 Washington County Of Utah

Property Tax Relief Client Case Studies Whom Have Saved

San Jose Tax Appeal Attorney San Francisco Tax Lawyer Offer In Compromise

San Francisco Property Tax 2022 Ultimate Guide To Sf Property Tax Rates Search Payments Due Dates

San Francisco 49ers County Property Tax Appeal Wins Out Of The Ordinary 50 Cut Silicon Valley Business Journal

Property Tax Services In San Jose Ca Paradigm Tax Group

Santa Clara County Sees Increase In Value Of Taxable Properties San Jose Spotlight

Santa Clara Property Tax Invoke Tax Partners

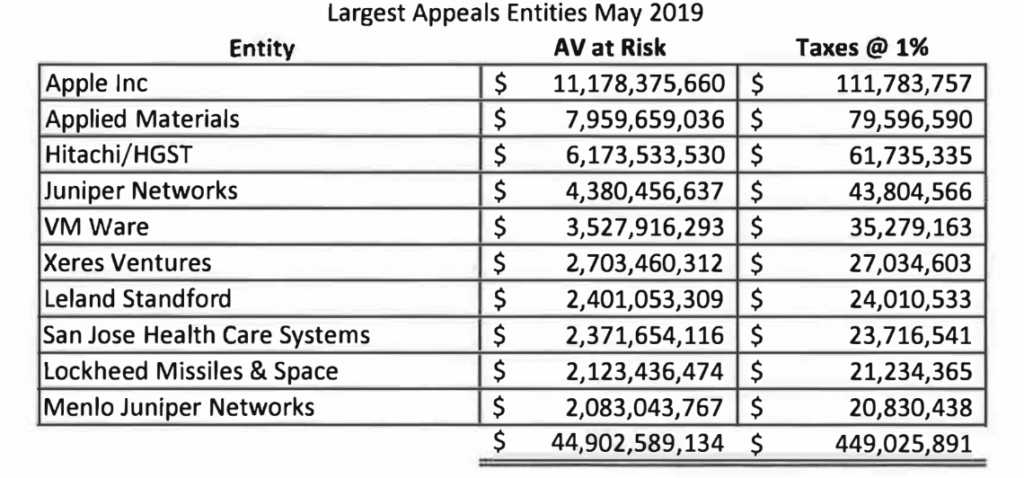

Tech Companies Buoy Property Assessments Appeals In Santa Clara County San Jose Spotlight

Tech Companies Buoy Property Assessments Appeals In Santa Clara County San Jose Spotlight

Does Inability To Pay Property Taxes Lead To Losing Your Home Mansion Global

/cdn.vox-cdn.com/uploads/chorus_asset/file/12055857/shutterstock_1135091624.jpg)

Apple Genentech Hold Up Silicon Valley For Billions On Property Tax Curbed Sf

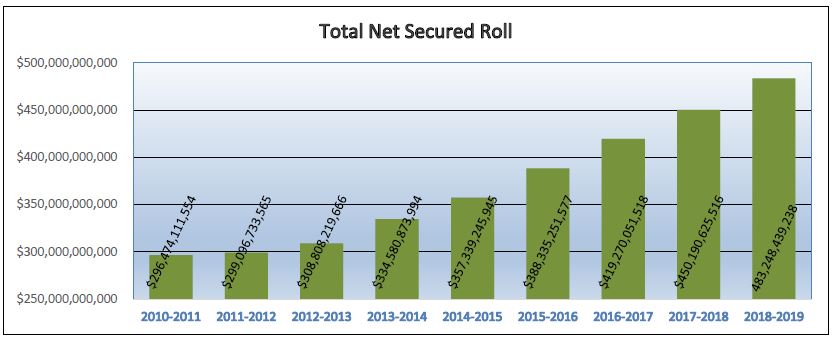

Assessment Roll Grows 33 Billion Sixth Year Of Greater Than 6 Growth

San Francisco Property Tax 2022 Ultimate Guide To Sf Property Tax Rates Search Payments Due Dates

Property Tax Disputes Moskowitz Llp Tax Law Firm

Assessment Appeals Office Of The Clerk Of The Board Of Supervisors County Of Santa Clara

County Of Santa Clara On Twitter Sccgov Dept Of Tax And Collections Issues Announcement About Prepayment Of Propertytaxes Accepting Current Years S 2nd Installment Due April 10 2018 But Not Prepayment Of Future